Setting out to investigate the effects of meme coins and NFTs on the world of cryptocurrency, we must consider the perspectives of both supporters and critics. By delving into the difficulties and prospects of these digital assets, we can better understand their influence on the evolution of the crypto sphere. This exploration will shed light on the challenges and opportunities posed by these digital assets, allowing us to better understand their role in shaping the future of crypto. A Dangerous Distraction Meme coins and NFTs are again on the rise, and critics argue that these phenomena pose a threat to the cryptocurrency industry. Sham projects proliferate, and unsuspecting investors often buy into assets without fully grasping their value or risks. This “get rich quick” mentality distracts from blockchain’s transformative potential, diverting attention and resources from projects with more significant long-term implications.

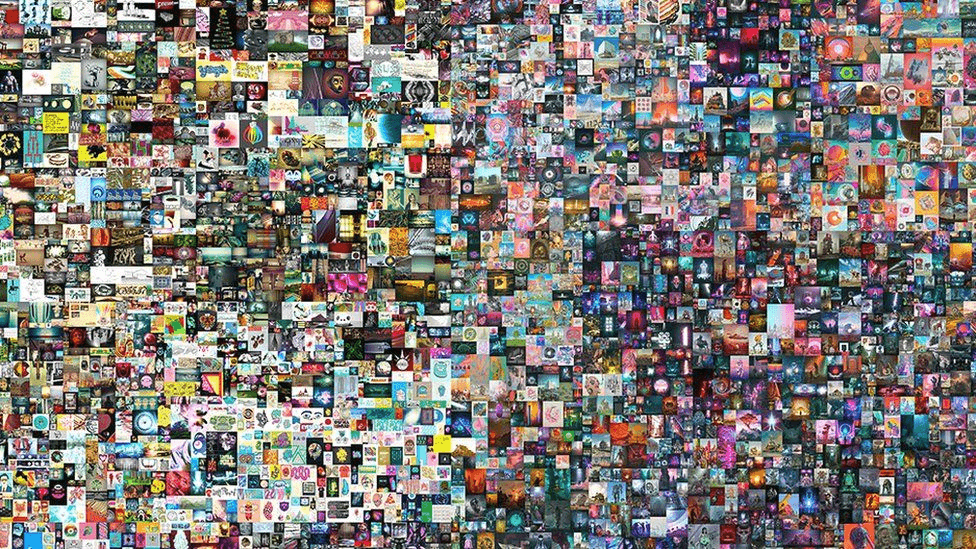

The Meme Coin Craze: Beyond Dogecoin and Shiba Inu Dogecoin, Shiba Inu, and other meme coins have skyrocketed in popularity. These tokens, often inspired by internet memes and social media trends, have attracted significant media attention and substantial investments. Fans claim these tokens democratize investment, allowing everyday people to participate in the crypto market. Skeptics, however, worry about the impact of these volatile assets on the broader crypto market. They argue that when these speculative bubbles burst, they could destabilize the industry and tarnish its reputation. For instance, the meteoric rise and subsequent crash of coins like Squid Game Token have demonstrated the dangers of speculative investing in meme coins. It stretches the bounds of reason when contemplating a mishmash of JPEG images that sold for $69 million dollars. Image / Beeple’s “Everydays” Non-Fungible Frenzy: The NFT Boom Similarly, NFTs took the world by storm in 2021. Artists, musicians, and collectors have embraced these unique tokens as a new way to monetize their creations. High-profile sales, such as Beeple’s “Everydays: The First 5000 Days” selling for $69 million, have attracted significant attention to the NFT market. Nevertheless, detractors say the NFT market’s rapid growth and exorbitant prices are unsustainable. They caution that an eventual collapse could harm not only NFT enthusiasts but also the broader crypto ecosystem. Recent controversies, such as the Bored Ape Yacht Club NFT collection’s alleged copyright infringement, highlight the need for a more robust legal framework in the space. Top NFT Blockchains by NFT Trading Volume January 2023 | DappRadar An Unnecessary Diversion: The Opportunity Cost Critics maintain that the enthusiasm surrounding meme coins and NFTs distracts from more meaningful blockchain projects.

As investors chase quick profits, they overlook initiatives that could revolutionize industries like finance, healthcare, and supply chain management. For example, decentralized finance (DeFi) projects aim to provide more accessible and transparent financial services, while blockchain-based supply chain solutions can improve efficiency and reduce fraud. These groundbreaking applications of blockchain technology could have far-reaching implications, but they risk being overshadowed by the hype surrounding meme coins and NFTs. Proponents of meme coins and NFTs view them as a natural evolution of the cryptocurrency landscape. They argue that these assets reflect an expanding interest in digital currencies and showcase the flexibility of blockchain technology. In this light, meme coins and NFTs are not distractions but rather innovative experiments that push the boundaries of what is possible in the crypto world. The Power of Community: Fostering Adoption Supporters also contend that meme coins and NFTs foster community engagement, which is vital for the crypto ecosystem’s growth. The success of these assets hinges on the power of social networks and shared interests. This sense of belonging, they argue, can drive the adoption of cryptocurrencies and blockchain technology as people seek to be part of something bigger than themselves. The Regulatory Landscape: Balancing Innovation and Protection As meme coins and NFTs continue to grow in popularity, regulators worldwide grapple with how to govern these new assets. Striking the right balance between fostering innovation and protecting investors from fraud and market manipulation is a delicate task.

The introduction of clearer regulatory frameworks could help legitimize the space. While ensuring that investors are protected from potential scams and unscrupulous actors. Striking a Balance: Coexistence and Collaboration The debate surrounding meme coins and NFTs raises important questions about the future of cryptocurrency. Are these assets a boon or a bane for the industry? Can they coexist alongside more serious blockchain projects? The answer likely lies somewhere in the middle, recognizing the potential of meme coins and NFTs to attract new users while also acknowledging the risks they pose to the market’s stability and reputation. Collaboration between traditional blockchain projects and the meme coin and NFT communities could be one solution to this issue. These groups could work together to advance the entire crypto ecosystem by sharing knowledge, resources, and expertise. Thus ensuring that innovation continues to thrive while minimizing potential pitfalls. An Industry at a Crossroads The cryptocurrency industry faces a crucial test as meme coins and NFTs continue to capture headlines and divide opinions. The challenge lies in embracing innovation and fostering community without losing sight of the transformative potential of blockchain technology. Striking the right balance will be key to ensuring a bright future for the world of digital assets. The cryptocurrency ecosystem must navigate this crossroads carefully, assessing the merits and drawbacks of meme coins and NFTs while promoting collaboration and focusing on blockchain technology’s revolutionary potential. By doing so, the industry can continue to evolve and thrive in a manner that benefits all stakeholders. The post Are Meme Coins and NFTs Killing Crypto? appeared first on BeInCrypto.

Source : [Are Meme Coins and NFTs Killing Crypto?](beincrypto.com/meme-coins-nfts-killing-crypto/) by Jay Speakman - BeInCrypto by Jay Speakman / April 26, 2023