Market & Ticker: Ripple – XRP/USDT

Date: 07/08/2023

Horizon / Timing: Tactical Mid-term / 1 to 3 months

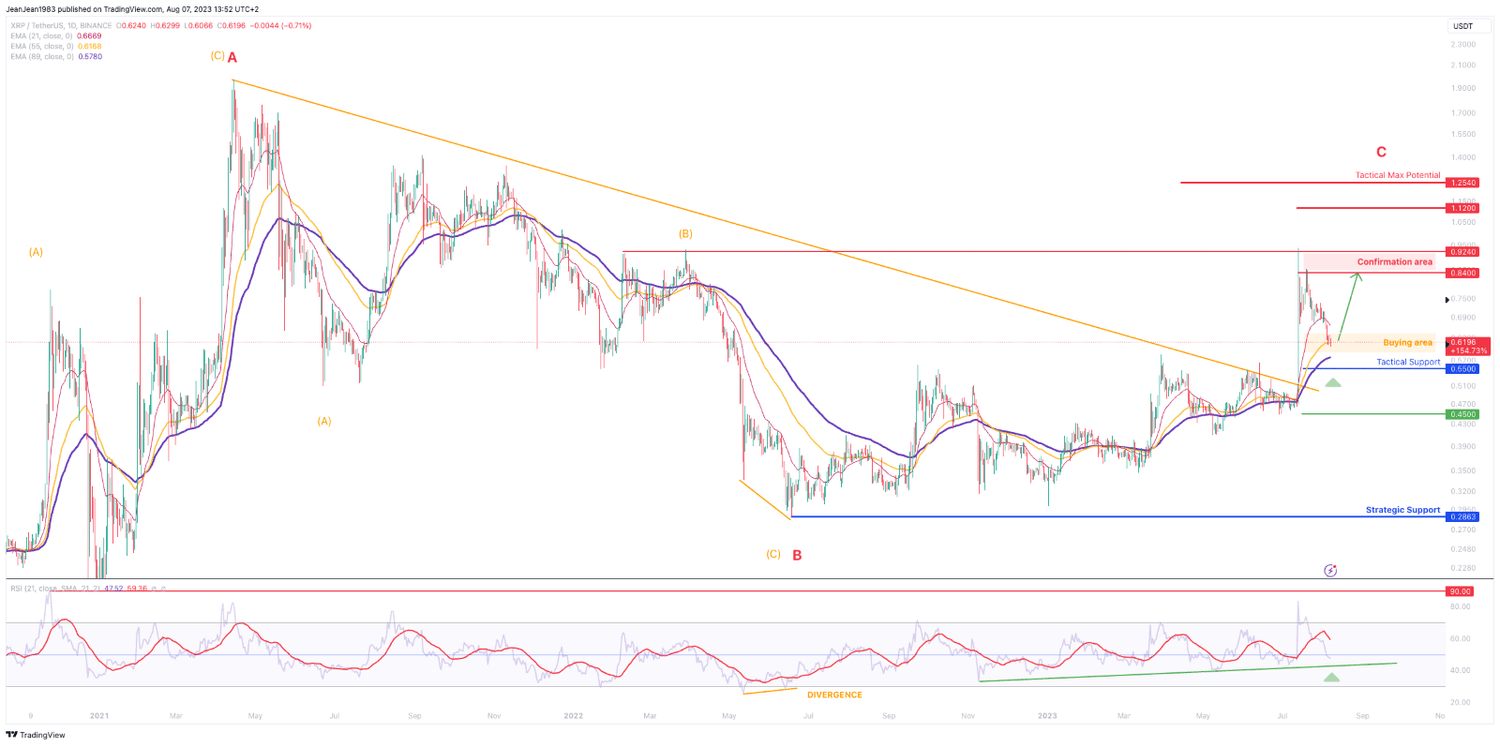

Scenario:

XRP recently surges after having lowered the classification of token as a security by the US Regulator (SEC). This offer an opportunity to enter in a bullish trend significantly underrated since the fight between Ripple and the SEC started.

The scenario is to buy the dip on current level to catch a volatile upside move towards 0,84 and 0,9240 corresponding to the last resistance challenged recently as long as 0,55 remains a support valid in daily close. Only a clear break in daily close above 0,9240 would open the door towards 1,12 and 1,2540

We also want to highlight the regulation risk still going on the Ripple project – the price action will be impacted by the new flow between the SEC and Ripple. (See below)

Ripple and the SEC

Since late 2020, Ripple Labs, the creators of the XRP token, has been locked in a legal battle with the United States Securities and Exchange Commission. The big question is whether or not XRP is a security.

On Dec. 22, 2020, the SEC filed a lawsuit against Ripple Labs and two of its executives on the grounds that they traded $1.3 billion in their XRP token as security without registering it with the commission. There have been arguments for and against the lawsuit. However, Ripple has strongly countered the claims, arguing that the SEC has been biased in its assessment.

Based on the commission’s definition of XRP in its lawsuit, the cryptocurrency would pass the Howey test, and according to SEC regulations, all securities must be registered.

👉 While most companies targeted by the SEC in a similar matter chose to settle, Ripple decided to fight. The outcome of the lawsuit will undoubtedly have far-reaching implications in the crypto space. If Ripple prevails, the SEC could lose some of its credibility, giving other crypto-based companies the confidence to revolt. On the flip side, if the SEC wins the case, it could upend the way crypto firms operate and usher in a new wave of registration rules that apply to securities.

Technical Key Elements:

- Bullish exit from the previous bear trend confirmed.

- RSI indicator is close to ascending trend line (support)

- The Moving average crossed to the upside and act as support

- Fibonacci key support is adjusted at 0,55 while the Elliot wave shows upside potential towards 1,12 and 1,2540

Trade Idea conclusion: Buy - Conviction:

| Medium |

Target 2: 1,2540

Target 1: 1,12

Confirmation area at 0,84/0,9240

Buy: add in dip area 0,62

Stop: 0,55

Chart: Daily Basis (Candle Stick) - Logarithmic

Indicators: Exponential Moving Average (21/34/89) - RSI (21)

The content in this channel is not investment advice but information to help you make the best decisions.. DYOR